How Much Does a Tractor Cost?

How Much Is My Tractor Worth?

Best Tractors for Small Farms

How Much Does a Tractor Tire Weigh?

Most Useful Tractor Implements

Most Popular Tractor Brands

What are Hay Balers?

How Many Bales of Hay Per Acre Can You Produce?

Tractors & Road Safety

What Does PTO Stand for on a Tractor? And How Does It Work?

Compact Vs. Utility Tractors: Which Is Right for Your Farm?

Best Tractor Models for Small to Medium Farms

How To Operate a Skid Steer

Skid Steer Attachments

Manure Spreaders

Grapple Buckets

How Do Combine Harvesters Work?

Autonomous Tractors

Considering a Stocker Cattle Operation?

What is an Excavator?

How much does a Forklift Cost?

How Much Does a Bulldozer Weigh?

Different Types Of Cattle Barns

How Is Hemp Harvested?

How Does a Concrete Crusher Work? Understanding the Role and Mechanisms of Concrete Crushers

A Beginner’s Guide to Online Farm Equipment Auctions

How to Harvest Basil in Your Farm or Garden

How Online Farm Auctions Are Transforming the Ag Industry

Corn Harvesting: Where Is Corn Grown in the U.S.?

How to Write Off Farm Equipment on Taxes

Bale Beds for Sale New & Used

Guide to Tillage: What Is Tillage Equipment & Its Process?

Evolution of the Bulldozer

Bulldozers in Construction

How Cinnamon Is Harvested

Selling Used Farm Equipment

Understanding Commodity Price Trends

Top Tips for Successful Bidding in Online Farm Equipment Auctions

Most Efficient Corn Harvesting

Top Seeders for No-Till Farming

Square vs Round Balers

How to Write Off Farm Equipment on Taxes

Disclaimer: This should not replace professional financial tax counsel for your particular assets.

There are many tax write-offs in farming and agriculture, including new and used farm equipment, machinery, and vehicles. To maximize what you can take, follow these steps for identifying and filing for your deductions.

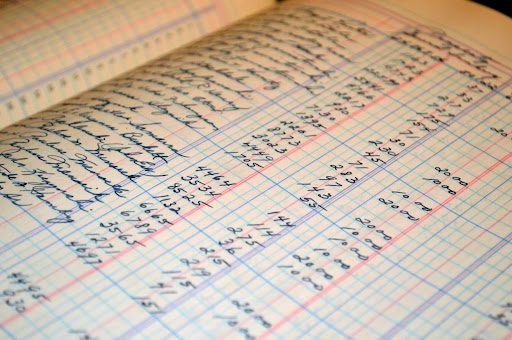

1. Keep Detailed Records of Equipment History

Maintain detailed records of your expenses from farm equipment. This includes the purchase of new or used farm equipment (with the date you purchased it and how you use the equipment), as well as money spent on maintenance and repairs for ongoing operations.

2. Identify Eligible Farm Equipment Tax Deductions

Eligible farm equipment includes new or used machinery, vehicles, or equipment used for business operations. Repairs and maintenance on your equipment can also be included in tax deductions as long as those improvements were made in the year you’re filing for.

3. Decide Between Section 179 Deduction, Bonus Depreciation, or Both

Next, you’ll want to decide between filing Section 179, bonus depreciation, or both.

What’s the Difference Between Section 179 and Bonus Depreciation?

Section 179 allows you to deduct the total cost of your qualifying farm equipment (up to a certain amount) purchased in the previous year; bonus depreciation is an additional deduction (with an unlimited amount) you can make to gain back farm equipment depreciation, typically after the Section 179 limit has been reached.

Section 179

Previously, capital expenses, like new farm equipment, were excluded from tax deductions. In an effort to encourage business investments, Section 179 was enacted. The 2023 cap that can be written off under this policy is $1.16 million for equipment purchases totaling $2.89 million. Keep in mind this total includes farm equipment purchases, as well as other operating expenses.

While this may sound appealing, it’s important to dig a little deeper into Section 179 with a financial advisor or tax professional to make sure it’s a good fit for you. For example, there are some cons to taking this if you plan to pass down assets to your next generation or took the deduction in the previous year. You can learn more about the pros and cons of Section 179 here.

Bonus Depreciation

Bonus depreciation allows for a certain deduction percentage on new or used equipment. For 2023, the total depreciation amount is 80% of total purchase price and will continue to decrease in the coming years. AgDirect shows the depreciation dropping by 20% each year until the year 2027.

Can You Take Both?

Often, the Section 179 spending cap prompts taxpayers to use bonus depreciation to cover the rest. However, both Section 179 and bonus depreciation should only be taken if it makes financial sense for you.

4. Complete Necessary Tax Forms

Taxpayers should use Schedule F (Form 1040) to file income and expenses from farming. The IRS provides detailed instructions on Schedule F forms on their website.

5. Reference Farmer’s Tax Guide for Additional Help

As you complete required tax forms, you may have additional questions. Refer to the IRS Publication 225, “Farmer’s Tax Guide” for direction.

6. Use a Professional Accountant

Tax laws are confusing enough when you aren’t running your own business. If you purchased a lot of equipment in the last year, find a tax professional who specializes in agricultural tax deductions. Not only can they help you file your taxes accurately, but they can provide projections and guidance as to how you should file everything for the given year.

[CTA: Find Farm Equipment for 2024]